Commercial P&C underwriters are highly trained knowledge workers, with median salaries often exceeding $80,000 and top earners making well over $120,000 annually. They are paid to be analytical, strategic thinkers who can accurately assess complex risks. Yet, a significant portion of their expensive time is spent on work that requires none of that expertise. A McKinsey study found that underwriters spend up to 40 percent of their time on purely administrative tasks.

This is the central problem creating the submission backlogs that plague the industry. Critical, revenue-generating work gets stuck behind a wall of manual document checks, data entry, and endless email chains chasing missing information. Carriers are paying expert salaries for administrative work, and it’s a losing proposition.

Why Old Automation Was Never the Answer

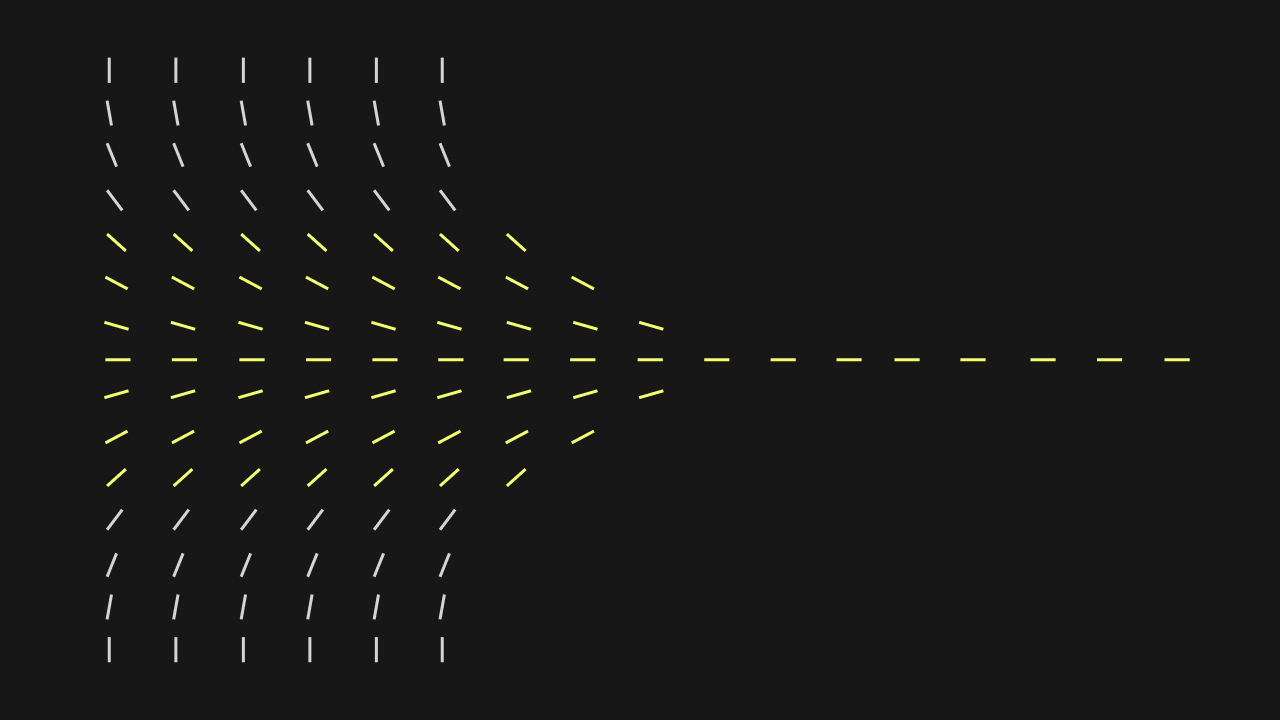

The initial wave of automation, RPA (Robotic Process Automation), was tried in the insurance space and largely failed to solve this problem. RPA relies on brittle bots designed to mimic human clicks in a stable environment. But insurance submissions are the opposite of stable.

An RPA bot can’t adapt when a broker sends a supplemental questionnaire in a new PDF format. It can’t read and comprehend the unstructured text in a multi-page loss history report. It breaks when confronted with the dozens of variations in ACORD forms, endorsements, and invoices that make up a single submission. This inability to handle variability and unstructured data meant RPA could only ever automate the most trivial, repetitive tasks, leaving the core underwriting workload untouched.

The Language of Insurance is English. Your Automation Should Speak It Too.

The business of insurance is conducted in human language, contained within contracts, reports, and emails. A truly transformative automation solution must be fluent in that language. Kognitos is built on this principle, using agentic AI to automate processes in plain English.

Instead of programming a rigid bot, you instruct Kognitos on your underwriting process as you would a person. The system can:

- Read and Understand: Ingest entire submission packages from an inbox and interpret the content of every document (with built in intelligent document processing), from loss history reports to bills of lading.

- Reason and Validate: Cross-reference information across all documents to check for consistency, completeness, and adherence to your specific underwriting guidelines.

- Act and Escalate: Digitize and structure the data for core systems, and intelligently flag exceptions or missing items for human review.

This is a system that works with the complexity of insurance, not against it.

Beyond Point Solutions: Why a Unified Platform Wins

Many carriers have turned to specialized insuretech point solutions to solve the underwriting intake problem. While these tools can offer temporary relief, they contribute to a larger strategic issue: a bloated and fragmented tech stack and increased technical debt. Major analyst firms like Boston Consulting group also show evidence that the insurance industry as a whole has been shown to be an early leader in overall AI adoption and solution piloting. This raises concerns not only for additional sprawl of point solutions but increased risk for so-called “shadow AI.” Insurance CIOs are now actively trying to consolidate vendors and create unified platforms. A tool that only handles underwriting submissions becomes another silo to manage, integrate, and maintain.

Kognitos provides a single, generative AI platform that can automate underwriting submissions and extend to other critical business processes like claims processing, premium auditing, and financial operations. This approach delivers immediate value for underwriting while providing a scalable solution for enterprise-wide automation, reducing total cost of ownership and simplifying the IT landscape. Even major carriers like Chubb emphasize that digital transformation is key to improving experiences for brokers and clients, a goal best served by a cohesive platform rather than a patchwork of tools.

The New Reality: Strategic, Data-Driven Underwriting

By eliminating the administrative backlog, agentic automation creates a powerful ripple effect of benefits for both the underwriter and the carrier.

For the Underwriter: The daily grind of chasing paper is replaced by high-value, satisfying work. Underwriters are freed to focus on deep risk analysis, building stronger broker relationships, and mentoring junior team members. This leads directly to higher job satisfaction, skill development, and a significant reduction in employee burnout and churn.

For the Carrier: The entire business operates at a higher level.

- Improved Risk Selection: With more time for analysis, underwriters can better align new business with the company’s risk appetite.

- Increased Revenue: Faster quote-to-bind times mean fewer valuable policies are left “on the table” or lost to more nimble competitors.

- Enhanced Broker Relationships: Quick, efficient processing makes the carrier easier to do business with, attracting more submissions from top brokers.

Ultimately, automating the submission process allows carriers to unlock the full potential of their most valuable asset: their people.