The insurance sector, a domain historically grounded in meticulous statistical analysis and complex risk models, now stands on the cusp of an unparalleled transformation. The surging capabilities of Generative AI, coupled with the burgeoning autonomy of intelligent AI agents, are fundamentally altering how insurers operate, engage with their clientele, and manage core business functions. For accounting, finance, and technology executives within sprawling insurance enterprises, grasping these advanced AI paradigms is no longer a mere technical consideration; it constitutes a pivotal strategic imperative for future competitiveness and enduring operational resilience.

This exposé aims to illuminate the profound transformative power and tangible applications of Generative AI in Insurance and sophisticated AI agents within the industry. We will precisely define these emergent AI concepts, unravel their operational mechanics, and delineate the substantial benefits they confer in elevating customer experiences, streamlining core operations, boosting efficiency, and catalyzing innovation across critical insurance use cases such as intricate claims management, rigorous risk analysis, bespoke policy origination, and hyper-personalized customer engagements. By showcasing specific, highly relevant applications and illustrating how AI is charting the future course of diverse insurance functions, this content delivers a comprehensive synthesis. Its ultimate purpose is to serve as an indispensable resource for organizations in the insurance sector striving to explore and implement advanced AI-driven solutions, championing their role in achieving unparalleled productivity, strategic advantage, and robust preparedness for future operational paradigms.

The Influx of Generative AI and AI Agents into Insurance

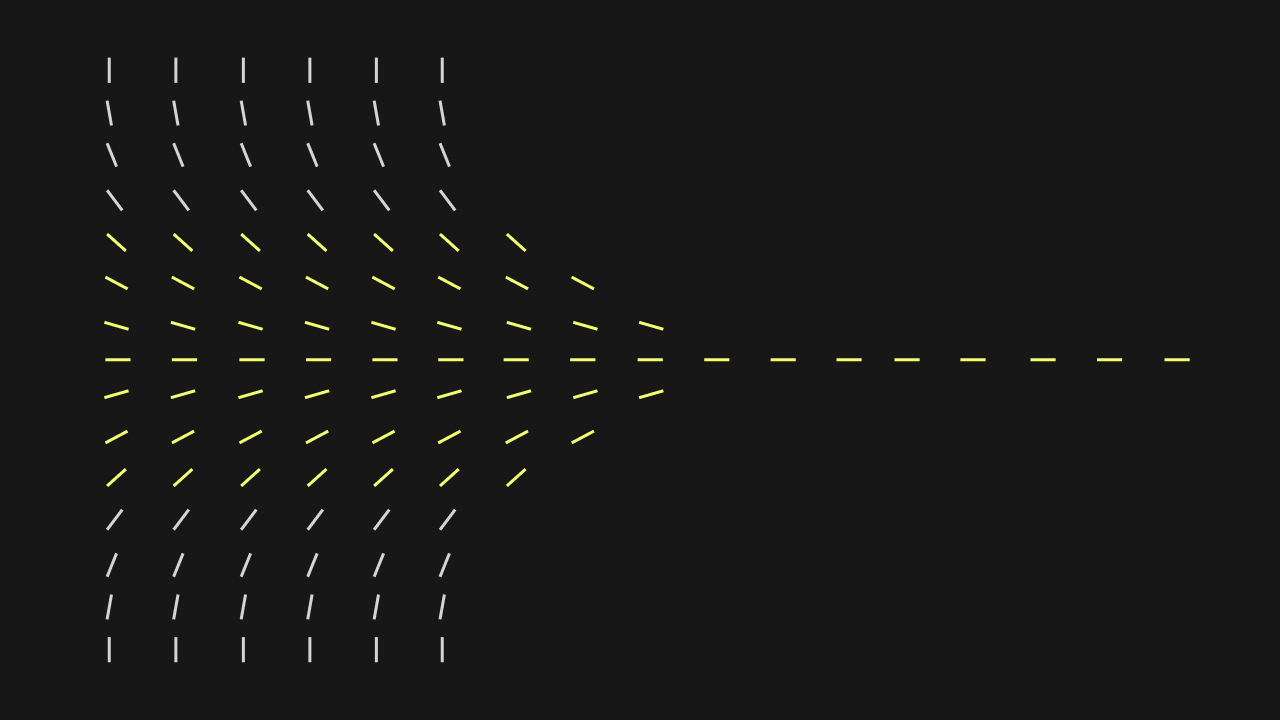

The insurance industry, while traditionally cautious, faces a mounting wave of data and an escalating demand for deeply personalized services. Conventional automation techniques, often rooted in rigid, rule-bound systems, consistently falter when confronted with the vast swathes of unstructured data and the nuanced decision-making inherent in insurance operations. This crucial void is precisely where Generative AI and intelligent AI agents converge to provide solutions. Generative AI excels at fabricating novel, original content—ranging from textual narratives and visual imagery to executable code—based on intricate learned patterns. AI agents, conversely, operate as autonomous entities capable of deciphering complex objectives, devising multi-stage action plans, and adapting seamlessly to unforeseen circumstances.

Their synergistic power introduces an entirely new dimension to Generative AI in Insurance, moving beyond rudimentary automation to deliver truly cognitive assistance. This fundamental paradigm shift represents the gateway to unlocking unprecedented levels of efficiency, precision, and innovation across the entire insurance value chain.

Pivotal Use Cases of Generative AI in Insurance

The application of Generative AI in Insurance is both expansive and profoundly impactful, promising to redefine core operational processes. Here are several prominent use cases:

- Accelerated Claims Processing: Claims management teams are frequently overwhelmed by unstructured information derived from claim forms, damage assessments, visual evidence, and customer dialogues. Generative AI can rapidly synthesize this disparate data, autonomously drafting initial claim summaries, accurately assessing potential liabilities, and even composing tailored communications for policyholders. This dramatically expedites initial claim handling, lightens administrative burdens, and enhances overall accuracy.

- Refined Risk Analysis and Underwriting: Gen AI in underwriting empowers insurers to scrutinize vast, fragmented datasets—including unstructured external intelligence like news reports or social media insights—to generate more exhaustive risk profiles. It can simulate various hypothetical scenarios, aiding actuaries and underwriters in gaining a deeper understanding of potential exposures, leading to more precise pricing and robust risk mitigation strategies. Moreover, it can assist in formulating intricate policy clauses tailored to specific risk factors.

- Streamlined Policy Formulation and Personalization: Insurers can harness Generative AI to automatically generate bespoke policy documents, endorsements, and renewal notices. Based on individual customer profiles and precise requirements, Generative AI in insurance can formulate customized policy language, ensuring both accuracy and consistency while significantly reducing the time required for policy issuance. This culminates in hyper-personalized product offerings.

- Transformative Customer Engagement and Support: Generative AI underpins highly sophisticated virtual assistants and intelligent chatbots, fundamentally reshaping customer support. These advanced AI agents can manage an extensive array of inquiries, from detailed policy explanations and real-time claims status updates to personalized financial advice, leveraging natural language comprehension to decipher nuanced requests. They can even generate bespoke responses, ensuring immediate, accurate service and freeing human agents to address more complex, empathetic issues.

- Empowering Insurance Marketing and Sales: Insurance marketing teams can deploy Generative AI to craft personalized marketing content, compelling ad copy, and effective sales scripts specifically tailored to distinct customer segments. It can produce engaging content across multiple channels, accelerating campaign development cycles and improving overall engagement metrics.

- Bolstering Fraud Detection Capabilities: Generative AI plays a critical role in proactive risk mitigation. It can meticulously analyze patterns within claims data, pinpointing subtle anomalies that suggest fraudulent activity, and even synthesize realistic synthetic data sets to train more resilient fraud detection models. This significantly enhances the capacity of claims management teams to identify and prevent illicit activities.

- Automated Regulatory Compliance Support: The insurance industry operates under stringent regulatory oversight. Generative AI can assist in drafting comprehensive compliance reports, summarizing complex regulatory updates, and ensuring policy documents strictly adhere to the latest legal requirements. This substantially reduces manual compliance efforts and mitigates associated risks.

These Gen AI use cases in insurance emphatically underscore the breadth of its transformative potential across the entire insurance value chain.

The Operational Revolution Driven by AI Agents in Insurance

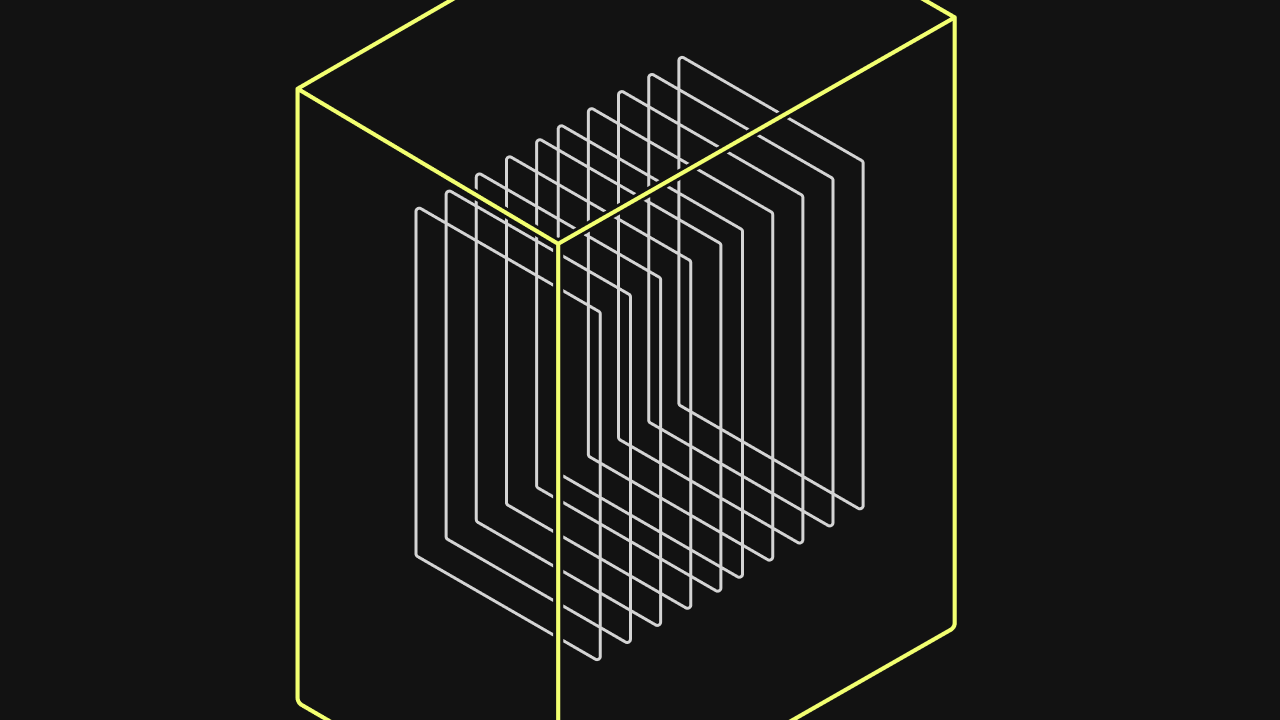

Beyond Generative AI’s prowess in content generation, the true operational revolution within the insurance sector is being catalyzed by the strategic deployment of intelligent AI agents. These autonomous software entities, fundamentally powered by advanced AI reasoning, are capable of understanding overarching goals, formulating multi-step action plans, and adapting intelligently to unforeseen circumstances across complex, intertwined workflows. They constitute the very backbone of next-generation intelligent automation in insurance.

How AI agents are fundamentally transforming insurance operations:

- End-to-End Claims Lifecycle Orchestration: AI agents can orchestrate the entirety of the claims journey. They receive initial claim submissions, intelligently extract pertinent data from diverse documents (both structured and unstructured), rigorously validate information, seamlessly communicate with adjusters and policyholders, and even initiate payments—all while managing exceptions with inherent autonomy. This allows claims management teams to pivot their focus towards intricate, high-value cases rather than routine administrative burdens.

- Dynamic Risk Exposure Assessment: AI agents are capable of continuously monitoring vast external data streams (e.g., evolving weather patterns, real-time news feeds, macroeconomic indicators) alongside internal policy and claims data to dynamically re-evaluate risk profiles. They can proactively identify emerging risks, generate updated risk assessments, and trigger automated alerts or policy adjustments for human underwriters.

- Personalized Customer Journey Management: AI agents oversee complex customer interactions that extend far beyond simplistic chatbot responses. They can expertly guide customers through intricate policy modifications, offer tailored product recommendations based on learned behavioral patterns, and proactively disseminate crucial updates, thereby ensuring a seamless and profoundly personalized customer experience.

- Automated Underwriting Augmentation: AI agents can diligently gather all requisite applicant data, cross-reference it against various databases, identify any missing information, and even draft preliminary underwriting reports. This empowers human underwriters to concentrate on complex judgments and nuanced risk evaluation, rather than tedious data compilation, significantly accelerating the underwriting process.

These use cases definitively underscore how AI agents are propelling insurance operations towards unprecedented levels of autonomy and embedded intelligence.

Kognitos: Intelligent Automation for Insurance Sector Excellence

While numerous software solutions claim to offer automation, Kognitos presents a fundamentally distinct and more potent methodology, explicitly engineered for the nuanced, document-intensive, and exception-laden workflows endemic to the insurance industry. Kognitos delivers natural language process automation, rendering it exceptionally proficient across all Generative AI in Insurance use cases and broader intelligent automation requirements for the sector.

Kognitos empowers sophisticated Generative AI in Insurance applications and comprehensive AI-driven automation by:

- Understanding Business Intent via Natural Language: Insurance professionals, who deeply grasp the intricate details of claims, policy wordings, and risk models, can directly define and modify complex workflows using plain English. Kognitos’s sophisticated AI reasoning engine translates this human intent into executable automation, entirely removing any reliance on complex programming languages or restrictive visual modeling. This capability is paramount for both claims management teams and insurance marketing teams.

- Intelligent Exception Handling Prowess: Insurance operations are inherently dynamic and often unpredictable. Kognitos’s AI reasoning can intelligently detect, diagnose, and resolve unforeseen exceptions (e.g., non-standard claim submissions, missing policy data points, complex fraud indicators), adapt fluidly to process variations, and even seamlessly integrate human-in-the-loop for crucial approvals or nuanced judgments. This guarantees remarkably resilient automation, even in the most challenging scenarios.

- Empowering Business Professionals Directly: Kognitos fundamentally democratizes automation, decisively shifting control from specialized IT teams squarely into the hands of the business owners themselves. This dramatically accelerates deployment timelines, curtails IT backlogs, and ensures that automations precisely align with real-world operational needs for all use cases.

- Enterprise-Grade, Purpose-Built AI: Kognitos provides exceptionally robust, secure, and highly scalable artificial intelligence explicitly engineered for demanding enterprise process automation. It is not a generalized AI tool, but one meticulously purpose-built for the stringent rigor and exacting compliance demands pervasive in large insurance organizations, particularly for sensitive Gen AI use cases in insurance.

- Seamless Interoperability: Kognitos integrates effortlessly with existing core insurance platforms (e.g., policy administration systems, claims management systems, CRM), ensuring data flows freely and intelligently across the entire enterprise, creating a cohesive operational ecosystem.

By leveraging Kognitos, insurance enterprises can transcend conventional automation paradigms to achieve truly intelligent, remarkably adaptive, and profoundly human-centric operations, thereby securing unparalleled efficiency and formidable strategic agility in an increasingly complex and competitive market.

The Future Horizon of AI in Insurance

The trajectory of Generative AI in Insurance, synergistically combined with the potent capabilities of intelligent AI agents, decisively points towards an increasingly automated, personalized, and exceptionally efficient industry. We can anticipate:

- Hyper-Personalization at Scale: AI will empower insurers to proffer truly individualized products and services, anticipating client needs with remarkable foresight and delivering proactive, tailored solutions.

- Predictive Operational Excellence: AI will transcend mere reactive processing, actively predicting claims occurrences, identifying nascent risks, and optimizing resource allocation with precision before issues fully materialize.

- Autonomous Workflow Orchestration: Intelligent AI agents will assume greater responsibility for orchestrating more end-to-end processes across critical domains like claims, underwriting, and customer support, intelligently managing exceptions and escalating only genuinely complex issues to human experts.

- Enhanced Human-AI Synergy: Insurance professionals will work seamlessly alongside advanced AI, leveraging its formidable power for data synthesis, intricate risk analysis, and dynamic content generation. This liberation from mundane tasks will empower them to focus on cultivating strategic relationships and tackling complex problem-solving.

By embracing intelligent automation platforms like Kognitos, insurance organizations can confidently navigate this transformative era, effectively converting the formidable power of Generative AI in Insurance and intelligent AI agents into an enduring, powerful competitive advantage.