Operational disruptions are inevitable in the dynamic world of large enterprises. Problems in Business Management represent the underlying causes of recurring incidents that impact services, productivity, and customer satisfaction. Problem management is the IT Service Management (ITSM) process focused on minimizing the adverse impact of incidents caused by errors in the infrastructure, and preventing recurrence of incidents related to those errors. It goes beyond simply resolving immediate issues; its aim is to identify, analyze, and eliminate the root causes of problems.

This article explores how Artificial Intelligence (AI) fundamentally transforms problem management, moving it from a challenging, often manual, and reactive process to a proactive, intelligent, and efficient capability. For corporate leaders, understanding this shift is crucial for building more resilient and effective operational frameworks.

Historically, addressing problems in business management has been a complex and resource-intensive endeavor. Traditional problem management often relies heavily on human expertise, manual data correlation, and reactive responses. This approach frequently results in prolonged investigation times and recurring service disruptions. The very nature of a challenging process like root cause analysis can overwhelm teams without the right tools.

This leads to a cycle of reactive problem management. Teams spend significant time firefighting, responding to symptoms rather than eliminating the underlying causes. Such an approach strains resources, increases operational costs, and degrades service quality. Furthermore, without a systematic way to learn from past issues, the same problems tend to resurface, impacting business continuity and employee productivity. The limitations of manual correlation underscore the need for a new paradigm.

Artificial intelligence fundamentally redefines problem management, particularly in the critical initial phase of identification. AI-powered systems excel at processing vast quantities of disparate data, enabling them to pinpoint emerging problems in business management with unprecedented speed and accuracy. This significantly enhances problem management capabilities.

AI transforms identification through:

By leveraging AI, organizations gain a far clearer and earlier view of operational challenges, fundamentally improving their ability to manage problems in business management.

Once potential problems in business management are identified, the next critical step is to pinpoint their root causes and implement lasting solutions. Here, AI significantly augments human intelligence, transforming the often arduous task of problem solving. This capability is a game-changer for enhancing problem management capabilities.

AI assists in root cause analysis by:

This AI-driven approach introduces elements of Lean sigma by continuously improving the efficiency and effectiveness of problem resolution, moving problem management beyond a challenging process to a streamlined function.

The ultimate goal of modern problem management is to move beyond simply reacting to issues. AI is the pivotal technology that enables a truly proactive problem management strategy, preventing problems in business management before they ever impact operations. This is a fundamental shift from traditional approaches, which were inherently reactive problem management.

AI fosters proactivity through:

This predictive power of AI ensures that organizations can anticipate and address vulnerabilities, minimizing service disruptions and maintaining high levels of operational resilience. This is a critical evolution for effective business process management.

For enterprises seeking to truly transform their approach to problems in business management, Kognitos offers a unique and powerful platform that inherently enables advanced problem management capabilities through its patented natural language AI and profound AI reasoning, making enterprise-grade automation accessible for orchestrating intelligent problem management processes.

Kognitos empowers leaders to automate intricate problem management workflows using plain English. This innovative approach bridges the gap between IT and operational teams, allowing for greater agility and control over intelligent automations. Our neurosymbolic AI architecture ensures precision and inherently eliminates AI hallucinations, providing robust AI governance and control over every automated step, which is crucial for managing sensitive problems in business management.

Kognitos streamlines the entire journey to intelligent problem management, making advanced problem-solving practical, scalable, and inherently secure for large enterprises.

AI’s transformative influence extends beyond problem management into related domains like Incident management and crisis response. By providing rapid insights and automating critical actions, AI significantly enhances an organization’s ability to navigate high-pressure situations.

In Incident management, AI can automate incident logging, intelligent routing to the correct support team, and even suggest immediate workarounds based on similar past incidents. AI-driven monitoring detects anomalies, escalating issues faster than manual methods. This significantly reduces mean time to resolution (MTTR) by enabling quicker identification and more efficient response to IT incidents.

In crisis management, AI provides critical support by rapidly processing vast amounts of information from multiple sources (news feeds, social media, internal reports) to detect emerging threats or assess public sentiment during a crisis. AI can automate communication protocols, disseminate critical information to relevant stakeholders, and even simulate potential crisis scenarios for better preparedness. This allows organizations to react more strategically and mitigate impact during times of high stress.

While the benefits of applying AI to problems in business management are compelling, integrating these advanced capabilities requires careful planning. Organizations must proactively address potential hurdles for successful deployment.

Common challenges include:

Addressing these challenges systematically is key to unlocking the full potential of AI-enhanced problem management.

The future of operational resilience hinges on the intelligent application of AI to problems in business management. As enterprises navigate increasingly complex digital environments, the ability to move from reactive problem management to a truly proactive problem management approach will define their success. AI is not just a tool; it’s a strategic partner in building robust, self-improving operational frameworks.

By empowering businesses to automate tasks like root cause analysis, solution deployment, and continuous learning through natural language AI, Kognitos enables organizations to minimize disruptions, maximize efficiency, and foster truly resilient operations. This marks a significant leap beyond typical RPA problem management approaches, delivering a new standard for intelligent business process management.

Digital transformation is the reimagining of organizational processes by using technology to improve service, deliver better customer experiences, and streamline operations. Technology improvements over the past two decades have had a profound impact on efficiency across virtually every industry. For example, the digitization of medical records has enhanced data accessibility and patient care, and digital banking transactions and mobile platforms have given consumers seamless, secure interactions with their banking institutions.

These transformations have laid the groundwork for more adaptive, connected, and efficient organizations. As AI reaches maturity, we’re watching it collide with digital transformation efforts, providing organizations with an unprecedented opportunity to either accelerate or create a new efficiency era. AI doesn’t simply enhance existing digital efficiencies. It serves as the catalyst for creating new opportunities for innovation and productivity.

AI’s transformative power will drive a new era of efficiency where processes are not only automated but are self-correcting and continuously improving. It also provides organizations with the tools to explore new business models, personalize customer experiences, and respond rapidly to changing market needs.

2025 is poised to be a landmark year for digital transformation. Previous initiatives have been complex, slow, and costly. But AI stands to change the landscape completely by offering technology leaders the opportunity to reduce the resources it takes to truly embrace the future and relinquish our grasp on legacy and analog technologies. AI will make digital transformation more affordable, accurate, and smarter.

This year, CIOs are expected to prioritize preparing their teams for AI adoption by fine-tuning data management practices and boosting training initiatives, rather than undertaking bold, sweeping AI transformations. Let’s explore the key AI trends that will shape digital transformation in 2025.

Agentic AI automation will become mainstream, as organizations look to shift away from legacy rule-based automation systems like robotic process automation (RPA). AI agents—autonomous agents capable of making decisions with minimal human intervention—are revolutionizing automation, and are widely expected to replace RPA bots.

They have the potential to seamlessly integrate into existing business processes and manage dynamic workflows. The rise of AI agents will allow organizations to redirect their teams back toward work that supports innovation and strategic growth.

Generative AI can create content and simulate human-like decision-making. The initial wave of GenAI hype has died down (giving way to agentic AI), but it will continue to play a pivotal role in hyper-personalizing customer experiences.

Organizations will leverage generative AI to analyze datasets, predict customer preferences, and deliver tailored interactions. As generative AI tools become more and more sophisticated, businesses can anticipate customer needs with unprecedented accuracy.

Organizations rely on clean data to make strategic business decisions. AI agents have the potential to redefine data governance frameworks. These autonomous agents can streamline data management processes to ensure compliance, accuracy, and security.

AI agents can monitor data in real-time, flag potential risks, and automate incident response, effectively safeguarding organizational data. Enhanced data governance not only protects sensitive information, but also helps businesses maintain consumer trust.

Global sustainability initiatives will encourage organizations to align digital transformation efforts with environmental goals. Despite well-documented concerns about the impact of AI use, it can play a vital role in sustainable practices by automating energy management, optimizing supply chains, and reducing waste.

Businesses will harness AI to track environmental impact and make data-driven decisions to minimize their carbon footprint. This trend reflects a commitment to corporate responsibility while unlocking cost savings and operational efficiencies.

These digital transformation trends underscore the role AI will play in driving organizational success in 2025 and beyond. Embracing AI will allow organizations to unlock new opportunities, achieve their strategic objectives, and maintain a competitive edge.

Digital transformation has been a long, complex, and expensive endeavor. AI is changing the game completely. Organizations can streamline processes with fewer resources in a more affordable and intelligent way with Kognitos. Our hyperautomation lifecycle (HAL) platform turns simple instructions into powerful, self-maintaining AI agents.

Kognitos empowers businesses to embrace the full potential of their digital transformation efforts by consolidating point solutions into a single, comprehensive platform that boasts an impressive suite of built-in AI skills—including intelligent document processing (IDP), optical character recognition (OCR), and voice transcription.

If you’re eager to embrace AI in 2025, reach out to a member of our team to see how Kognitos might fit into your digital transformation strategies, or sign up for free community trial access to our HAL platform today.

Kognitos’ HAL (hyperautomation lifecycle) platform is a game-changer for organizations looking to implement agentic AI automation, save time, deliver value, and reduce technical debt. As point solutions for automation and AI agents emerge, Kognitos stands apart as a platform that meets complexity head-on, while remaining user friendly.

HAL is automating the entire lifecycle of automation, beginning with its innovative auto-write feature.

At its core, hyperautomation enables organizations to automate processes at scale. The demand for automation has always been high, but the resources required to support traditional automation kept large-scale adoption out of reach. HAL is designed to bring together each stage of the hyperautomation lifecycle, providing a single, integrated solution that not only automates tasks, but also manages and optimizes them.

The platform is built upon a cutting-edge, neurosymbolic hybrid AI that combines the creativity of generative AI with deterministic logic to deliver accurate, repeatable, and hallucination-free AI agents. In short, HAL is an end-to-end automation solution. The five steps of the hyperautomation lifecycle are:

Let’s dive deeper into HAL’s auto-write functionality.

Each new automation created in HAL begins with the auto-write feature. Users can create sophisticated workflows from simple instructions, eliminating the need for complex coding or technical expertise.

Where in the past a new process automation may have required months of planning and design, with HAL you can have an automation with as little as a prompt or SOP (standard operating procedure) document. Here’s how it works:

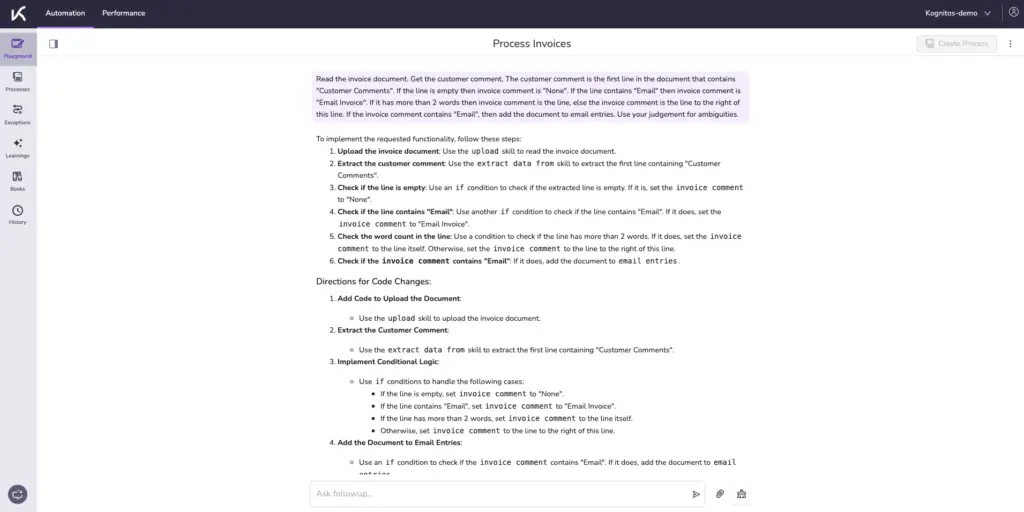

Users input their SOPs or simple instructions into the platform in plain English. HAL can even prompt users to auto-generate instructions for common use cases like generating reports in Excel, processing invoices, data reconciliation, and more.

HAL reviews the prompt or the instructions you provide, then generates a detailed plan in deterministic English, so both the machine and the human can understand. This crucial, intermediate step is what makes AI trusted, auditable, and safe for use in mission critical business processes.

After outlining the steps above, HAL auto-writes the automation. You review the automation, and simply click “Apply” if everything looks correct.

To run your automation through the rest of the stages of HAL, click “Accept all” and then run the process. It’s that simple. Start to finish, you can create your agent in minutes.

Auto-write makes creating powerful enterprise automations simpler than ever before. It can streamline a variety of use cases. Our customers have found particular success with intelligent document processing (IDP) and Excel-based tasks, such as invoice processing and data consolidation.

Instead of investing time and resources on programming bots, HAL can create self-sustaining AI agents capable of automating complex business processes. If you have an SOP, you now have an AI agent.

HAL and its auto-write feature are revolutionizing the way the industry does automation. If you’re ready to experience the power of auto-write and the full capabilities of HAL, sign up for free community trial access to HAL, and create your first AI agent today.

The day to day tasks of procurement teams can be overwhelming—managing vendor relationships, ensuring the best pricing, and more. Workflow automation can be a critical ally for procurement teams, enabling them to streamline processes, reduce human error, and make faster decisions.

Here are the top five ways procurement teams can harness workflow automation, demonstrating its transformative potential with real-world examples to illustrate its impact.

Procurement managers process hundreds or even thousands of purchase orders monthly. It’s a monumental task simply to keep up, not even considering timeliness and accuracy.

Workflow automation can completely automate the generation, approval, and tracking of purchase orders. It speeds up the entire process, from review to approval, while also reducing human error caused by manual data entry. As a result, the procurement team experiences improved efficiency and reduced processing costs, so they can instead focus their attention on strategic vendor negotiations.

Onboarding new vendors can be a lengthy process of collecting and verify documents. Supplier relationship managers can streamline the process by using workflow automation to gather required information, verify compliance, and update supplier records. Using these automated workflows ensures that vendor data stays accurate and up-to-date, enhances supplier reliability, and improves collaboration. The time gained by automating these tedious tasks frees up the team to engage in more value-added activities, such as strategy meetings with key suppliers.

The contract management team knows the risks of missing contract renewals and compliance requirements. Workflow automation allows them to track contract status, automate renewals, and alert the team of upcoming critical dates. Automation tools also reduces legal risks by ensuring that contract terms are aligned with procurement policies. With the time saved, employees can deliver value to the organization by analyzing contract performance and optimizing terms for future agreements.

For financial analysts within the procurement department, generating spend reports often requires consolidating data from multiple sources, a time-consuming and tedious effort. Rather than manually gathering data, it’s possible to use workflow automation to gather, collate, and analyze spend data seamlessly. Automated reporting provides these team members with real-time insights on spending trends and opportunities for cost savings. With this automation in place, the team can make informed decisions faster and propose strategic adjustments that align with the company’s financial goals.

Inventory managers are responsible for demand forecasting and stock replenishment. Workflow automation supports them by automatically monitoring inventory and requisition processes to ensure stock levels stay within range. Automated alerts notify them when inventory falls below set thresholds, so they can be more proactive in managing inventory. This automation helps the team avoid stockouts and overstock situations, optimizing inventory costs and improving service levels across the supply chain.

The examples above highlight how workflow automation can revolutionize procurement operations, providing significant benefits including increased efficiency and transparency, and reduced operational costs. Automation allows procurement teams to redefine how they spend the bulk of their time—strategically driving organizational growth and strengthening vendor relationships instead of completing tedious tasks.

Procurement teams that embrace workflow automation secure a competitive edge in the marketplace and drive toward a future of efficiency and innovation. If you are a leader looking to improve the procurement processes and workflows within your organization, consider implementing an AI-powered automation solution like Kognitos to drive sustainable success.

Hyperautomation and agentic AI will allow organizations to streamline processes, boost efficiency, and stay competitive in ways that haven’t been seen before. Enterprise technology leaders have a clear opportunity to harness these recent technological developments to drive organizational success by combining the power of hyperautomation with the execution of AI agents.

Originally coined by Gartner, hyperautomation is more than just another buzzword in the automation landscape (see: agentic AI)—it’s an enterprise-level strategy that enables automation at scale. Whatever can be automated, must be automated.

Hyperautomation was originally conceived of as a network of tools to automate virtually every process within an organization. In the years since Gartner first introduced the concept, the definition has shifted slightly. Rather than relying on a complex tech stack to automate workflows within an organization, many leaders are looking to consolidate incumbent platforms while still achieving the same level of automation.

Incumbent automation providers have met challenges every step of the way with slow progress, high costs, limited scale, and fragility. Hyperautomation has the potential to overcome these challenges.

While many solutions offer automation components that work in tandem with additional platforms to hyperautomate processes, Kognitos’ HAL platform provides an integrated solution that encapsulates every stage of the hyperautomation lifecycle. HAL is designed not just to automate tasks, but also to manage and optimize them.

The concept of hyperautomation looks beyond what automation can achieve today to emphasize a continuous lifecycle of improvement. The hyperautomation lifecycle provides a systematic approach over these key stages:

HAL has created a unified automation ecosystem, as opposed to the disparate systems and platforms in legacy hyperautomation efforts. The cloud-based, scalable platform seamlessly integrates with existing technologies, allowing CIOs to execute upon hyperautomation strategies without overhauling their current tech stack.

Minimize exposure to external threats with HAL’s scalable infrastructure. Most endpoints, except for user interfaces (UI) and management APIs, are inaccessible through the public internet. The UI endpoints are safeguarded through API gateways, ensuring an added layer of protection. All this is made possible by the fact that our platform is underpinned by a serverless technology, allowing you to avoid maintaining underlying infrastructure, reducing costs and driving down total cost of ownership.

We combined intuitive generative AI with deterministic programming to create HAL—the trusted platform that combines accuracy with flexibility. Throughout the lifecycle, HAL can make autonomous decisions, but recognizes when it needs human input, and trusts the expertise of the team.

When HAL meets an exception, it asks for human input in natural language. Our patented conversational exception handling allows anyone who knows the process to provide the platform with feedback, so it can quickly adapt to drive perpetual refinement

For technology leaders eager to leverage cutting-edge technologies, the potential rewards of hyperautomation are immense: greater efficiency, enhanced operational agility, and the capacity to foster a culture of constant learning and adaptation.

As the landscape of business continues to change, hyperautomation is not just an opportunity—it’s a mandate. With Kognitos’ Hyperautomation Lifecycle platform, organizations have the means to not only catch up with the future but to lead it. Embrace hyperautomation with HAL and craft the dynamic, intelligent enterprise of tomorrow.

Bank Risk Management stands as an absolute imperative in the highly regulated and interconnected world of finance. It’s the structured process by which financial institutions identify, assess, monitor, and mitigate various risks that could jeopardize their capital, earnings, or reputation. This comprehensive approach is not just about avoiding losses; it’s about ensuring stability, fostering growth, and maintaining public trust.

Effective Bank Risk Management empowers financial leaders, CIOs, and technology heads to navigate a landscape filled with unpredictable challenges. It transforms potential threats into manageable scenarios, allowing banks to operate securely and efficiently. Understanding this crucial discipline is foundational for anyone involved in the strategic direction and operational integrity of a banking institution.

The financial sector operates under constant scrutiny and faces dynamic global economic conditions. This makes the importance of risk management in the banking sector paramount. Banks handle vast sums of money, facilitate complex transactions, and are entrusted with the financial well-being of individuals and businesses. Without robust risk frameworks, instability can quickly cascade, leading to severe economic repercussions.

A well-defined risk management strategy safeguards against financial shocks, supports regulatory compliance, and protects stakeholder confidence. It’s the backbone of resilience, enabling banks to absorb unexpected losses, adapt to market shifts, and continue serving their clients effectively. Proactive Bank Risk Management builds a foundation of trust, essential for any institution seeking sustained success.

Banks contend with a multitude of potential threats that can impact their operations and profitability. A clear understanding of the various types of risks in banking sector is the first step towards effective mitigation. These risks are interconnected and require a holistic risk management strategy to address.

Primary categories include:

Each of these types of risks in banking sector demands specialized attention and integrated risk management solutions.

Effective Bank Risk Management isn’t a one-time task; it’s a continuous, cyclical process involving several critical stages. This structured approach ensures that risks are systematically identified, assessed, and managed. Understanding How Does the Risk Management in the Banking Process Work involves recognizing these interconnected steps.

The five key stages are:

This cyclical process ensures that a bank’s risk management strategy remains agile and responsive to evolving threats and opportunities.

The complexity of modern Bank Risk Management demands more than traditional methods. The integration of Artificial Intelligence (AI) and automation has emerged as a game-changer, offering powerful risk management solutions that enhance efficiency, accuracy, and real-time responsiveness. These technologies are crucial for strengthening a bank’s overall risk management strategy.

AI-driven analytics can process vast datasets quickly, identifying subtle patterns and predicting potential risks with far greater precision than manual methods. For instance, AI can significantly enhance cybersecurity defenses by detecting anomalous network activity in real time. Automation, conversely, streamlines repetitive compliance tasks, reduces human error in data processing, and accelerates various risk assessment and reporting workflows. This synergy empowers banks to shift from reactive measures to a proactive, predictive approach in managing complex risks, improving credit assessment, and enabling continuous monitoring.

Many financial institutions seek advanced risk management solutions but find traditional tools fall short. Kognitos offers a fundamentally different approach to Bank Risk Management, by transforming automation with natural language and AI reasoning, making enterprise-grade AI accessible to business users.

Kognitos empowers business teams to automate processes crucial for risk management using plain English. This bridges the gap between IT and risk/compliance operations, allowing for greater agility and control. Our platform leverages a neurosymbolic AI architecture that ensures precision and eliminates AI hallucinations, providing robust AI governance and control essential for mitigating operational and compliance risks. This positions Kognitos as a key tool that helps banks in addressing various risks effectively.

Kognitos innovations, like hundreds of pre-built workflows for finance and legal and built-in document and Excel processing, mean that common risk-prone processes, such as contract review or regulatory reporting, can be automated with inherent accuracy and traceability. Automatic agent regression testing ensures that as regulatory environments change, automations can adapt confidently, supporting a robust and evolving risk management strategy.

The application of advanced automation and AI through platforms like Kognitos provides tangible benefits for Bank Risk Management. These practical scenarios demonstrate how financial institutions can deploy innovative risk management solutions.

Consider these real-world examples:

These applications underscore how a sophisticated risk management strategy powered by AI and automation transforms the banking sector’s ability to identify, mitigate, and monitor risks effectively.

To develop a truly robust risk management strategy, banks must embrace continuous innovation and a holistic view of their operational landscape. The dynamic nature of the financial industry necessitates ongoing adaptation and technological adoption.

Key ways to strengthen your Bank Risk Management framework include:

By focusing on these areas, banks can build a resilient and forward-looking Bank Risk Management posture.

The future of Bank Risk Management is inextricably linked to advanced technological adoption. As regulatory environments become more complex and cyber threats more sophisticated, banks must move beyond traditional compliance checkboxes to truly intelligent, adaptive risk frameworks. The importance of risk management in the banking sector will only amplify.

Kognitos is uniquely positioned to drive this transformation. By empowering institutions with natural language AI for automation, we provide truly innovative risk management solutions that enhance visibility, streamline compliance, and build inherent resilience. For financial leaders, understanding Bank Risk Management is no longer just about compliance; it’s about leveraging AI and automation to secure a competitive edge and build enduring trust in an unpredictable world.

The insurance sector, a domain historically grounded in meticulous statistical analysis and complex risk models, now stands on the cusp of an unparalleled transformation. The surging capabilities of Generative AI, coupled with the burgeoning autonomy of intelligent AI agents, are fundamentally altering how insurers operate, engage with their clientele, and manage core business functions. For accounting, finance, and technology executives within sprawling insurance enterprises, grasping these advanced AI paradigms is no longer a mere technical consideration; it constitutes a pivotal strategic imperative for future competitiveness and enduring operational resilience.

This exposé aims to illuminate the profound transformative power and tangible applications of Generative AI in Insurance and sophisticated AI agents within the industry. We will precisely define these emergent AI concepts, unravel their operational mechanics, and delineate the substantial benefits they confer in elevating customer experiences, streamlining core operations, boosting efficiency, and catalyzing innovation across critical insurance use cases such as intricate claims management, rigorous risk analysis, bespoke policy origination, and hyper-personalized customer engagements. By showcasing specific, highly relevant applications and illustrating how AI is charting the future course of diverse insurance functions, this content delivers a comprehensive synthesis. Its ultimate purpose is to serve as an indispensable resource for organizations in the insurance sector striving to explore and implement advanced AI-driven solutions, championing their role in achieving unparalleled productivity, strategic advantage, and robust preparedness for future operational paradigms.

The insurance industry, while traditionally cautious, faces a mounting wave of data and an escalating demand for deeply personalized services. Conventional automation techniques, often rooted in rigid, rule-bound systems, consistently falter when confronted with the vast swathes of unstructured data and the nuanced decision-making inherent in insurance operations. This crucial void is precisely where Generative AI and intelligent AI agents converge to provide solutions. Generative AI excels at fabricating novel, original content—ranging from textual narratives and visual imagery to executable code—based on intricate learned patterns. AI agents, conversely, operate as autonomous entities capable of deciphering complex objectives, devising multi-stage action plans, and adapting seamlessly to unforeseen circumstances.

Their synergistic power introduces an entirely new dimension to Generative AI in Insurance, moving beyond rudimentary automation to deliver truly cognitive assistance. This fundamental paradigm shift represents the gateway to unlocking unprecedented levels of efficiency, precision, and innovation across the entire insurance value chain.

The application of Generative AI in Insurance is both expansive and profoundly impactful, promising to redefine core operational processes. Here are several prominent use cases:

These Gen AI use cases in insurance emphatically underscore the breadth of its transformative potential across the entire insurance value chain.

Beyond Generative AI’s prowess in content generation, the true operational revolution within the insurance sector is being catalyzed by the strategic deployment of intelligent AI agents. These autonomous software entities, fundamentally powered by advanced AI reasoning, are capable of understanding overarching goals, formulating multi-step action plans, and adapting intelligently to unforeseen circumstances across complex, intertwined workflows. They constitute the very backbone of next-generation intelligent automation in insurance.

How AI agents are fundamentally transforming insurance operations:

These use cases definitively underscore how AI agents are propelling insurance operations towards unprecedented levels of autonomy and embedded intelligence.

While numerous software solutions claim to offer automation, Kognitos presents a fundamentally distinct and more potent methodology, explicitly engineered for the nuanced, document-intensive, and exception-laden workflows endemic to the insurance industry. Kognitos delivers natural language process automation, rendering it exceptionally proficient across all Generative AI in Insurance use cases and broader intelligent automation requirements for the sector.

Kognitos empowers sophisticated Generative AI in Insurance applications and comprehensive AI-driven automation by:

By leveraging Kognitos, insurance enterprises can transcend conventional automation paradigms to achieve truly intelligent, remarkably adaptive, and profoundly human-centric operations, thereby securing unparalleled efficiency and formidable strategic agility in an increasingly complex and competitive market.

The trajectory of Generative AI in Insurance, synergistically combined with the potent capabilities of intelligent AI agents, decisively points towards an increasingly automated, personalized, and exceptionally efficient industry. We can anticipate:

By embracing intelligent automation platforms like Kognitos, insurance organizations can confidently navigate this transformative era, effectively converting the formidable power of Generative AI in Insurance and intelligent AI agents into an enduring, powerful competitive advantage.

The relentless pursuit of efficient loan origination and servicing stands as a non-negotiable imperative for both institutional prosperity and client satisfaction. Historically, the convoluted journey from initial loan application to final fund disbursement has been ensnared by manual complexities, voluminous paperwork, and protracted approval cycles. This intricate yet often sluggish process, vital for lending entities, inherently demands rigorous oversight. It is precisely within this critical domain that loan automation emerges as a transformative force. For leaders in financial organizations, grasping the profound impact of loan automation is indispensable for propelling operational excellence and forging an unassailable competitive advantage.

This article aims to explore the pivotal concept of loan automation. It will precisely define loan automation, articulate its operational mechanics, and delineate its profound transformative benefits for both lending institutions and prospective borrowers. These advantages encompass streamlining operational paradigms, dramatically elevating efficiency metrics, accelerating approval velocity, enhancing credit decisions through advanced artificial intelligence, fortifying risk management protocols, and significantly curtailing operational outlays. By meticulously showcasing diverse applications and compelling use cases across the entire loan lifecycle—including origination, servicing, underwriting, and fraud detection—this content provides a comprehensive overview that deepens comprehension of this critical financial practice. In essence, it serves as an indispensable resource for financial institutions seeking to embrace or optimize loan automation, championing its role in achieving swifter turnaround times, greater precision, and sustainable strategic growth.

Loan automation refers to the strategic application of cutting-edge technologies to meticulously streamline and autonomously manage various stages of the loan lifecycle. This encompasses the entire journey from the initial application submission to subsequent servicing and collection activities. It fundamentally transmutes a historically cumbersome, document-laden process into a fluid, digital, and exceptionally efficient workflow.

This concept extends far beyond simply digitizing a traditional loan application form. Loan Automation involves integrating intelligent systems capable of:

The overarching objective of loan automation is to accelerate processing velocity, drastically curtail manual errors, and profoundly enhance the overall efficiency and profitability quotient of lending operations. This comprehensive technological pivot is actively reshaping the financial services industry.

To fully appreciate the transformative power inherent in loan automation, it is essential to first understand the traditional, human-intensive loan processing journey. What precisely are the duties of a loan processor in this conventional framework?

A loan processor traditionally functions as a critical intermediary, bridging the gap between a loan applicant and the underwriter. Their conventional role encompasses:

This traditionally human-intensive endeavor is precisely where automated loan processing manifests its profound impact, autonomously executing many of these verification and compilation tasks to dramatically accelerate the entire loan cycle. The core essence of loan process automation aims to render these steps virtually seamless.

The adoption of loan automation confers a compelling array of advantages that directly influence an organization’s lending efficacy, fiscal health, and crucial customer relationships. These benefits are indispensable for securing and maintaining a competitive edge in today’s fast-paced lending marketplace.

These compelling advantages unequivocally underscore why lending automation constitutes an indispensable strategic imperative for any financial institution striving for sustained market leadership.

The formidable power inherent in Loan Automation is underpinned by several sophisticated artificial intelligence technologies operating in meticulous synergy. These advanced capabilities fundamentally redefine what is achievable in terms of efficiency and precision within the lending domain.

These expertly combined AI capabilities culminate in a robust and intelligently comprehensive lending automation solution.

The profound transformative impact of loan automation is vividly brought to life through its myriad real-world applications spanning every critical stage of the loan lifecycle. These applications represent foundational use cases for any advanced automated loan software.

These diverse applications unequivocally underscore how loan automation fundamentally transforms the lending landscape, rendering it swifter, more precise, and inherently more secure.

While numerous loan automation software solutions offer some level of basic automation, Kognitos delivers a fundamentally distinct and profoundly more powerful approach. It is specifically engineered for the intricate, nuanced, and frequently exception-laden workflows inherent in loan processing within large financial enterprises. The Kognitos platform delivers natural language process automation, rendering it exceptionally proficient in revolutionizing lending automation.

Kognitos empowers sophisticated loan automation by:

By leveraging Kognitos, financial institutions can transcend traditional Loan Automation approaches, ascending to a realm of truly intelligent, remarkably adaptive, and profoundly human-centric loan processing. This bestows unparalleled efficiency, measurably accelerates approvals, and cultivates formidable strategic growth.

Adopting a modern Loan Automation software solution necessitates meticulous planning to maximize its profound impact and effectively mitigate potential risks.

The trajectory of Loan Automation is unequivocally towards even greater inherent intelligence, autonomy, and sophisticated predictive capabilities. The future of lending will be fundamentally characterized by:

By embracing intelligent automation platforms like Kognitos, businesses can truly transform their approach to Loan Automation, converting a traditionally complex process into an agile strategic asset for superior financial performance and accelerated growth.

In a large enterprise, financial reporting is the central nervous system. It connects every part of the business, from sales and operations to marketing, with the critical data needed for decision-making. When this system is healthy, the business can respond to market changes with agility and confidence. When it is ailing—plagued by manual data entry, disconnected spreadsheets, and cumbersome reconciliation—the entire organization suffers from a slow and inaccurate flow of information. The traditional, manual process is an anchor holding back a company’s ability to be truly competitive. This is the fundamental challenge that Financial Reporting Automation is built to address.

This article is for the CFO, controller, and technology leader who recognizes that the future of finance is not about faster spreadsheets. It’s about a complete transformation of the financial reporting process into an intelligent, autonomous system. We will explore a new approach to automating finance processes that moves past brittle, programming-dependent tools. It’s a strategy that empowers finance teams to heal the internal systems, shifting their focus from manual data entry to strategic analysis and insight.

For years, finance teams have relied on a mix of legacy tools and manual workarounds to manage the reporting cycle.

A modern Financial Reporting Automation strategy demands a solution that is intelligent, adaptable, and precise. It must be able to understand the intent of a process and handle exceptions on its own, without relying on brittle, programming-dependent tools.

The next generation of Automated financial reporting is not a static tool; it is an intelligent, autonomous agent. This agent can perceive its environment, reason through complex workflows, and act across multiple systems to get a job done. Kognitos has pioneered this agentic approach, providing a platform designed for the precision, transparency, and adaptability that finance requires. It is not a generic AI platform or a rigid rule-based system. It is a strategic solution for automating finance processes. The key is to transform the traditional, manual system into a healthy, AI-powered central nervous system.

Kognitos eliminates the gap between business needs and technical commands with “English as code.” Finance professionals can type processes in plain English, and the platform automatically documents and automates workflows, removing the need for programmers. This is the new way of implementing financial reporting automation.

Financial reporting demands accuracy. Kognitos’s patented neurosymbolic AI handles errors and new line items, combining symbolic AI’s reasoning with generative AI’s power. When encountering unfamiliar scenarios, it uses its Guidance Center to involve human experts, learning from their input and automatically updating processes via its Process Refinement Engine. This ensures robust, resilient automation for finance operations. This is a significant step forward in automating finance processes.

A modern Financial Reporting Automation strategy requires a unified platform. Kognitos offers built-in document and Excel processing, browser automation, and connectors to hundreds of enterprise applications. A single AI agent can manage complete workflows, from legacy ERP data to modern accounting systems. This approach consolidates the tech stack, reduces complexity, and ensures a cohesive automation strategy for finance teams. This is how automated financial systems can truly improve operational efficiency.

To understand the full potential of Financial Reporting Automation, we must look at the specific functions where it can have the greatest impact. Here are some key examples of how intelligent AI agents can transform finance operations.

The most time-consuming part of the reporting cycle is collecting data from a fragmented tech stack.

Ensuring data integrity is critical for producing accurate financial statements.

The process of creating and distributing routine reports is a repetitive, time-consuming task.

The strategic deployment of automated financial reporting brings a host of measurable benefits that go far beyond simple cost reduction.

Adopting AI is not without its challenges. The biggest hurdles are often legacy systems, data fragmentation, and a reliance on rigid, rule-based automation. The challenges in automating financial reporting include:

Kognitos’s platform is designed to mitigate these. Its ability to work with unstructured data and integrate with both modern and legacy systems ensures that a company can begin its AI journey without a complete overhaul of its existing infrastructure. Its natural language interface helps overcome the skills gap, as employees don’t need to be programmers to build and use automations.

The future of financial reporting automation is not a world without human professionals. It is a seamless, strategic partnership between intelligent AI agents and human expertise. The ultimate role of AI in finance is to empower human professionals with better tools, enabling them to focus on what truly matters: strategic analysis, forecasting, and business partnership.

As the industry continues to evolve, the distinction between manual work and strategic insight will blur. The data from various systems will flow instantly into the administrative systems, triggering intelligent workflows that ensure a smooth and compliant operation. The ability to build and grow an AI-driven back-office is the key to unlocking true operational excellence and securing a competitive advantage in the future.

2024 saw an explosion of generative AI, igniting conversations in virtually every industry about how the technology could improve efficiency in the workforce. While some of the hype around generative AI has since died down—Gartner predicts that more than 30% of GenAI projects will be abandoned by the end of 2025—incorporating AI is still a top priority for CIOs.

Organizations have already started consolidating their tech debt as they look to prove the value of AI initiatives, which we predict will ultimately result in the fall of incumbent technology solutions that solve for a single problem. With this market landscape in mind, here are our top predictions for enterprise AI in 2025:

AI agents will change the landscape by augmenting human work. Agents are capable of autonomous work and decision-making, covering everything from managing customer inquiries to developing software. Companies will be able to optimize resource allocation, increase agility, and drive efficiency across various departments.

But, buyer beware, agentic AI can suffer from a lack of process, oversight, and reliability without a proper plan in place. When done properly, we anticipate that integrating agentic AI solutions will allow businesses to scale AI efforts and quickly adapt to shifting market demands.

According to a survey done by McKinsey, AI can improve software project manager productivity by roughly 40%. As additional job roles adopt AI in their everyday workflows, we expect to see product development times dramatically decrease, as technology integrates design, prototyping, and testing into a seamless process. AI systems are increasingly capable of simulating diverse conditions and suggesting enhancements that may be overlooked by human engineers.

Process automation will serve as a critical conduit as AI becomes integral to the broader development lifecycle. These platforms will encapsulate the entirety of the automation journey—from ideation to market launch. Predictive analytics will be seamlessly embedded so teams can make informed decisions swiftly and confidently.

There has been little meaningful progress in AI governance despite the exponential increase of AI adoption. But, we predict that the status quo will shift dramatically in 2025. CIOs will have to abandon inconsistent AI oversight, and instead develop systematic and transparent strategies to ensure AI investments deliver sustained value while mitigating risk.

Organizations must rigorously assess and validate AI risk management practices to safeguard against potential missteps and ethical concerns. A recent survey indicates that just 45% of respondents who actively use AI have received training on safe AI use, raising the alarm on the concept of “shadow AI,” or the use of unapproved AI tools outside of an organization’s security framework. Furthermore, 38% of employees have shared sensitive information with an AI tool. This number increases to 46% and 43% for Gen Z and millennials. IT leaders must advocate for comprehensive oversight rather than waiting for global regulatory guidelines when the risk is this great.

As broad regulatory frameworks are introduced, companies must also remain aware of state-specific regulations which may be more stringent or even conflicting. Companies must stay nimble to balance innovation with compliance. In 2025, the ability to successfully integrate AI governance will differentiate proactive leaders from those who simply react to market pressure.

Each industry is uniquely impacted by AI and adopts at different rates. To stay competitive, businesses must quickly react to AI adoption. To better understand, let’s explore the technology industry and software development lifecycle (SDLC).

We expect that AI tools will revolutionize the SDLC from planning to deployment by reducing development time and minimizing human error at each step of the process, from automating code generation to testing and debugging. Tools like cursor.sh are already being widely adopted to create code, but the second—and arguably more important—half of the lifecycle will be addressed in 2025 to avoid a large-scale software maintenance nightmare.

AI tools can tailor development environments to industry-specific needs, such as cybersecurity in finance or compliance in healthcare, ensuring that applications meet regulatory standards while accelerating time-to-market.

Strategic AI initiatives will give organizations a competitive advantage in 2025. Let’s take a few industries as examples. Predictive AI models can simplify logistics operations by optimizing routing, managing inventory, anticipating demand fluctuations, and optimizing supply chain efficiency. Risk management and financial services organizations can use advanced AI analytics to detect potential fraud in real-time, safeguarding assets and building customer confidence. Lastly, AI healthcare applications can improve patient diagnoses, improve administrative processes, analyze images more quickly and accurately—PwC estimates that review and translation of some images can be up to 30 times faster with 99% accuracy using AI—and identify potential issues sooner for better outcomes.

AI investments are projected to surge to $200 billion by 2025, and the stage is set for unparalleled economic impact. Organizations that act swiftly and strategically—establishing data-driven cultures and adopting responsible AI practices—will harness AI not just for efficiency, but for meaningful innovation and sustained competitive advantage.

We stand at a pivotal moment where AI is no longer just a futuristic concept, but an integral, transformative enterprise strategy that drives innovation, efficiency, and competition. Organizations that wholeheartedly embrace this AI journey stand to redefine their benchmarks for success. Embracing AI is not just about improving current operations; it’s about positioning for future growth and resilience.

Kognitos helps organizations achieve rapid ROI on automation initiatives by transforming simple instructions into powerful AI agents capable of automating use cases across the enterprise. If AI investments are a priority in 2025, let’s talk.