Consider the anatomy of a perfect fraudulent claim: A claimant submits a report for a $25,000 intersection collision. The structured data is flawless: the policy is active, the premium is paid, and the driver has a clean record. Your legacy fraud detection system runs the numbers, checks the database fields, and flashes a green light. The check is automated, printed, and mailed.

Meanwhile, buried deep in the unstructured attachments, the evidence of fraud is screaming.

- The metadata on the crash scene photo shows it was taken three weeks before the alleged accident.

- The tow truck invoice has a font slightly different from the vendor’s standard template.

- The police report narrative mentions dry pavement, while NOAA weather data for that zip code confirms a thunderstorm.

Your system missed all of this. Why? Because the insurance industry has spent the last decade perfecting the math of fraud detection while ignoring the reading comprehension. We are bringing a calculator to a literacy test.

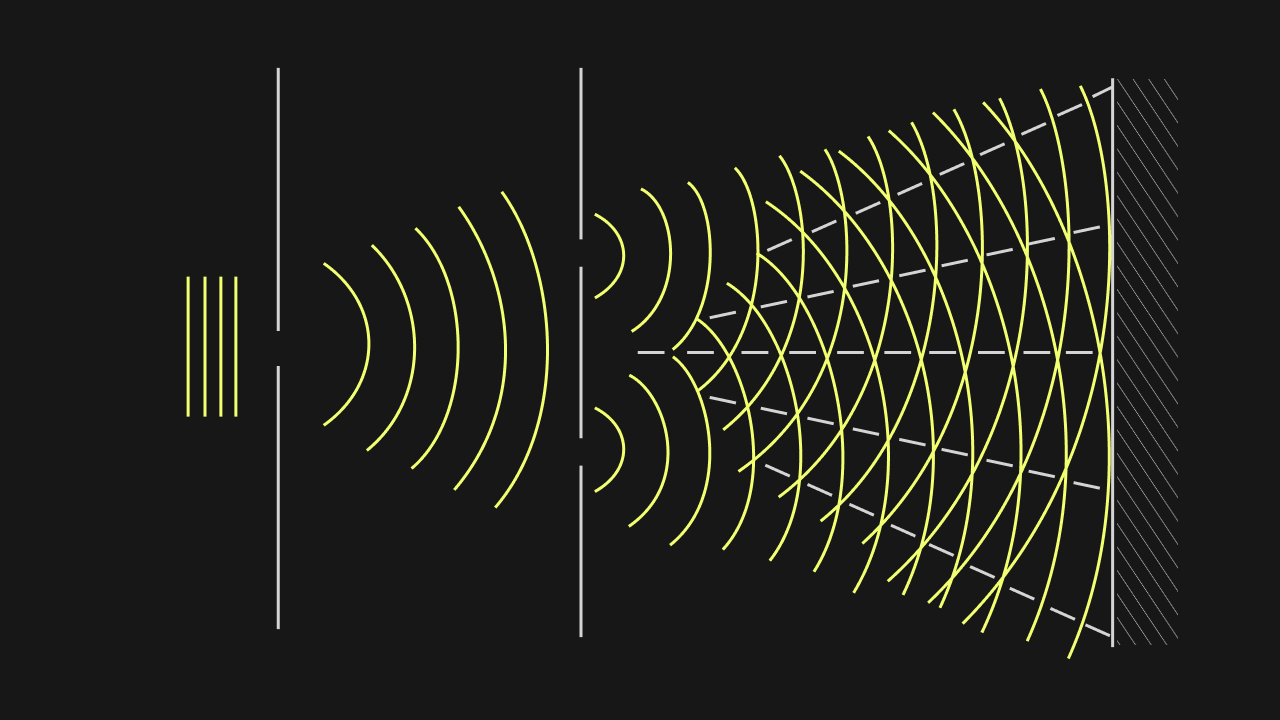

The problem with modern insurance claims fraud detection is not that our algorithms are bad; it is that they are blind. They are starving for the rich, unstructured data that contains the truth.

This article explores why the next leap in fraud prevention in insurance won’t come from a new statistical model, but from a new way of ingesting reality: Neurosymbolic AI.

The Gap Between Math and Meaning

To understand why insurance fraud detection software often misses the mark, we must look at the inputs.

A recent study published in Research in International Business and Finance highlights the power of algorithms like Support Vector Machines (SVM) and Naïve Bayes in predicting fraud. These models are excellent at identifying statistical patterns if they are fed the right variables- such as Policyholder’s Fault or precise accident locations.

But in the real world, these variables don’t exist in neat database rows. They are trapped in free-text narratives.

In a typical claims process, the “Fault” determination is buried in a paragraph written by an adjuster or a police officer.

- The Adjuster Note: “Driver admits to looking at phone, but claims the other car stopped abruptly.”

- The Database Field: Often remains null or generic until weeks later.

Because the predictive model cannot read the note, it misses the critical signal. It sees a standard fender bender. It does not see the admission of negligence that might trigger a staged accident flag. This Data Starvation turns powerful algorithms into expensive paperweights.

The Solution: Generative Extraction

Kognitos bridges this gap by using Generative AI as a Universal Parser. It acts as the pre-processing layer that feeds the fraud model.

When a First Notice of Loss (FNOL) arrives, the Kognitos Agent reads the attached documents—police reports, witness statements, repair estimates. It uses Large Language Models (LLMs) to answer specific questions:

- “Is the weather described in the police report consistent with the weather data for that zip code?”

- “Does the medical invoice date precede the accident date?”

It then extracts these answers as structured variables and feeds them into the carrier’s predictive model. Suddenly, the claims fraud analytics engine is no longer starving; it is feasting on high-fidelity data, drastically improving its accuracy.

The Glass Box Defense: Neurosymbolic Explainability

In the world of insurance claims fraud detection, being right is not enough. You must be able to prove why you are right.

This is the Black Box problem. If a deep learning model flags a claim as “95% Fraudulent,” but cannot explain the contributing factors, the Special Investigations Unit (SIU) is paralyzed. They cannot deny a claim based on a hunch from a machine, and they certainly cannot defend that denial in court.

Regulators are increasingly demanding transparency. A denial based on “The AI said so” is a regulatory fine waiting to happen.

Logic + Learning

Kognitos addresses this through Neurosymbolic AI. This architecture combines the reading ability of Generative AI (Neural) with the rigid logic of symbolic programming.

Instead of a vague score, Kognitos generates a natural language audit trail- a Glass Box.

System Log: “I flagged this claim for review because: 1) The repair estimate ($4,500) exceeds the Blue Book value of the vehicle ($3,200). 2) The metadata on the accident photo indicates it was taken 48 hours before the policy inception date.”

This is actionable intelligence. It gives the SIU investigator a clear lead to pursue. By providing the reasoning alongside the result, Neurosymbolic AI transforms fraud detection in insurance claims from a statistical probability into a defensible case file.

From Detection to Action: The Legacy Integration

The final mile of preventing insurance fraud is execution.

Imagine a scenario where your advanced AI successfully detects a fraudulent claim. It flags the risk in the analytics dashboard. But, because the analytics tool isn’t connected to the core claims system, the legacy mainframe (e.g., a 20-year-old COBOL system or an on-premise Guidewire instance) proceeds to auto-adjudicate and mail the check.

This “Disconnect of Action” is common. Building API integrations between modern AI tools and legacy mainframes is slow, expensive, and risky.

The Agentic Interface

Kognitos Agents solve this by acting through the User Interface (UI).

They possess the ability to log into the legacy claims system just like a human adjuster.

- Detect: The Neurosymbolic engine identifies a high-risk anomaly (e.g., duplicate invoice number).

- Act: The Agent instantly logs into the mainframe, navigates to the specific Claim ID, and toggles the status to “Payment Hold – SIU Review.”

- Notify: It routes the file to the appropriate investigator.

This capability ensures that insurance claims fraud detection translates immediately into financial protection. You stop the bleeding before the check is cut, without waiting months for IT to build a backend integration.

Use Cases: Where AI Shines

The application of this technology extends across all lines of business.

Auto Insurance: The Staged Accident

Staged accidents often involve conflicting narratives.

- The AI Role: The Agent compares the Description of Loss from the driver against the Damage Assessment from the body shop. If the driver describes a rear-end collision, but the shop reports side-impact damage, the Agent flags the inconsistency for insurance fraud detection.

Property: The Storm Chaser

After a hurricane, fraudulent roof claims spike.

- The AI Role: The Agent cross-references the Date of Loss on the claim with historical NOAA weather data for that specific address. It also analyzes the contractor’s invoice header to check if they are a known “Storm Chaser” entity flagged in other claims.

Life Insurance: The Contestability Check

Life insurance fraud detection often hinges on undisclosed medical history during the contestability period.

- The AI Role: The Agent ingests the Medical Examiner’s report (unstructured PDF) and searches for pre-existing conditions that were omitted from the original application. It structures this data to validate the claim eligibility automatically.

The Era of Intelligent Defense

The fraudsters of 2026 are using technology to fabricate evidence. It is time for carriers to use superior technology to dismantle it.

The future of insurance claims fraud detection is not just about crunching numbers; it is about understanding the story behind the claim. By leveraging Neurosymbolic AI to read unstructured evidence and explain its findings, carriers can finally solve the “Garbage In, Garbage Out” problem.

Kognitos offers the bridge between the mathematical potential of your fraud models and the messy reality of your data. It provides the eyes to see the evidence, the brain to explain the risk, and the hands to stop the payment.

What are some examples of AI in Insurance Claim Fraud Detection?

Examples include:

- Image Forensics: Detecting if a photo of a damaged car was Photoshopped or downloaded from the internet.

- Social Network Analysis: identifying rings of connected individuals (doctors, lawyers, claimants) involved in organized fraud.

NLP Analysis: Reading medical narratives to find discrepancies between the reported injury and the treatment provided.